Crap graphic, not the information, the manner in which it’s depicted. Shades = mass confusion.

According to the Wall Street Journal’s interpretation of the Fed’s Survey of Consumer Finances.

The gist of it:

“Rather than being left behind as all the gains in the economy accrue to billionaires, they have in fact seen bigger wealth gains over the past three years than the top 10% of families. Indeed, the biggest wealth gains between 2019 and 2022 were among the approximately 13 million families in the 80th to 90th percentile of the income distribution. Their median wealth jumped 69% from 2019, adjusted for inflation, to $747,000 in 2022.”

They note, “. . . the increase in net worth for these families has far outpaced inflation.”

They conclude:

“Rather than being swallowed by the 1%, the economy, according to these numbers, is creating a growing upper middle class. Many people got there by pursuing college degrees, steadily building retirement accounts and purchasing homes. For the most part, they became wealthy slowly, and were well-positioned when pandemic-era stimulus programs boosted asset values.”

As a result of inheriting some of their families’ growing assets, their children may very well end upper middle class too. Especially if they’re college educated.

The unreported on story of course, is the utter lack of social mobility for the other 80%, many of whom are not college graduates. Historically, the default mindset in the (dis)United States has been an assumption that each generation would enjoy a higher quality of life. Now, understandably, parents worry that their young adult children will not enjoy their level of economic security.

Catherine Rampell of The Washington Post argues neither major political party has a serious plan to deal with inflation overall or gas prices specifically. So the choice is between the two parties agendas. “So what do Republicans stand for?” she asks.

“Their national leaders won’t say, even when asked directly; their state-level rising stars are mostly focused on fighting with Mickey Mouse and drag queens. But if you look at GOP actions taken over the past several years, including when they had unified control of the federal government, you get a sense of what Republicans are likely to prioritize.

Mostly, Republicans seem to care about tax cuts for the wealthy and corporations. They want to find ways to repeal Obamacare, or otherwise reduce access to health care by (for example) slashingMedicaid.

They care about installing judges who will roll back reproductive rights.

They care about supporting a president who used the powers of the state to further his own political and financial interests, rather than those of the American public he was sworn to serve.

They care about supporting a presidency whose few purported diplomatic achievements, in retrospect, look largely like an excuse to meet potential investors who might fund Trump aides’ new private equity endeavors.

They care about defending, at all costs, a president who cheered on the mob seeking to hang his own vice president.

And they care about undermining the integrity of our election system and overturning the will of the voters, if and when vote tallies don’t go their way.”

In other words, the remote possibility of slightly cheaper gas could come with very high costs to our democracy and the common good.

“Over time, wealth inequality became more pernicious to society than income inequality. The problem is not just that a chief executive at a big company makes 33 times what a surgeon makes, and a surgeon makes nine times what an elementary-school teacher makes, and an elementary-school teacher makes twice what a person working the checkout at a dollar store makes—though that is a problem. It is that the chief executive also owns all of the apartments the cashiers live in, and their suppressed wages and hefty student-loan payments mean they can barely afford to make rent. ‘The key element shaping inequality is no longer the employment relationship, but rather whether one is able to buy assets that appreciate at a faster rate than both inflation and wages,’ Adkins, Cooper, and Konings argue in their excellent treatise, The Asset Economy. ‘The millennial generation is the first to experience this reality in its full force.’”

Annie Lowery, “The End of the Asset Economy,” The Atlantic.

You should be a fanatical Bear fan. No, not the hapless football team in Chicago, the bear stock market. You should be rooting for further losses, more blood letting, a crash for the ages even. For several years, it’s been impossible to get the first half of the investing equation right—buying low. Stocks are still fairly pricey, but if you’re a youngster of say 29 or 39 or 49, and you have any savings, do what you can to maintain the downward momentum. Don’t just sit there. Use your “go to” personal curses on the Fed. Write JP and tell him to raise interest rates to 10%. Start a war in a distant land and wreak additional havoc on supply chains.

Similarly, mobilize with other youth to pop the housing bubble. Get JP to raise interest rates to 10% so no one can afford a mortgage. Then go full-Amish and build a bunch of homes together to increase supply.

Down, down, down go equity and home prices. You got this.

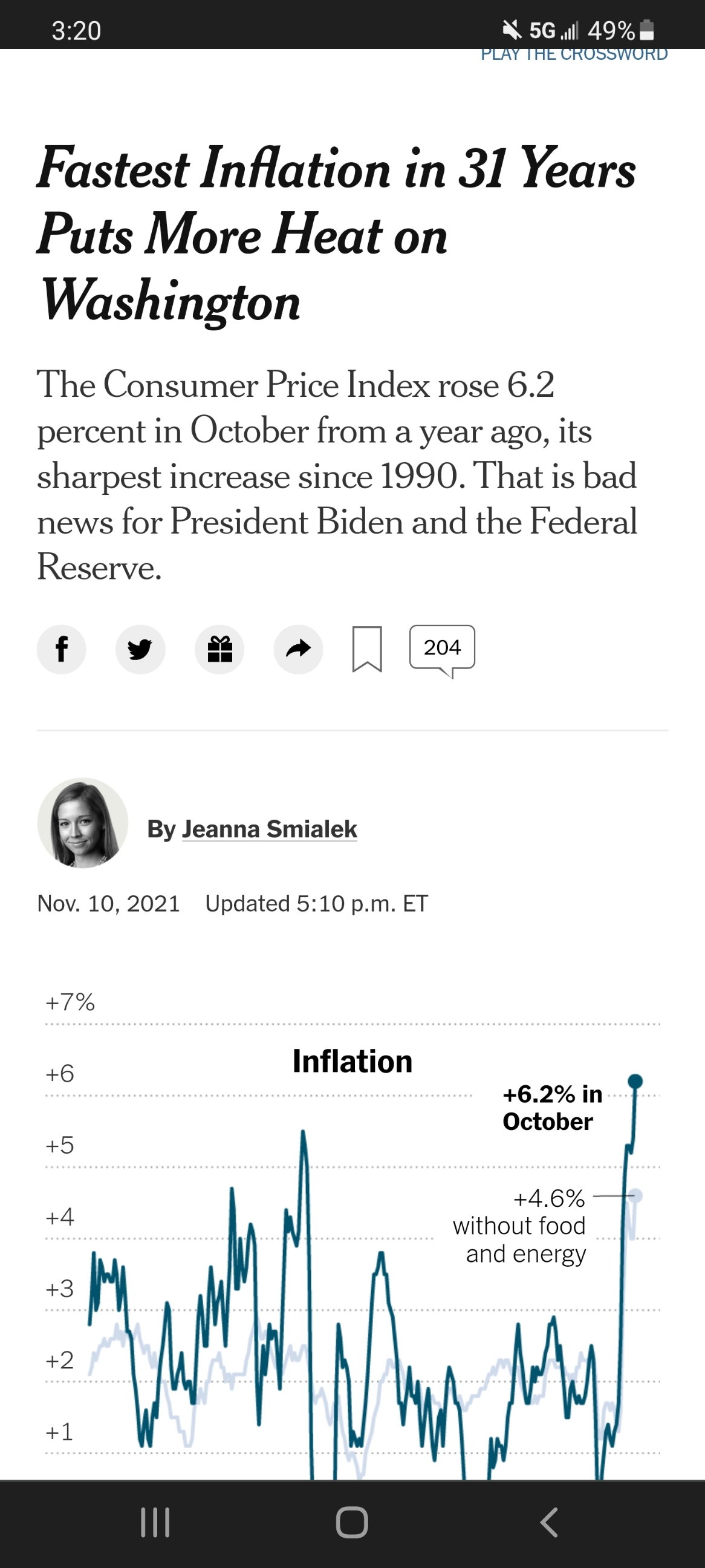

Inflation skyrocketing. The stock market in free fall.

Social scientists say we can’t multitask, but they haven’t met me. I’m doing pushups and watching a business news channel. A stock market expert/analyst just said there are several market “headwinds” including the invasion of KUWAIT. Then, a few sentences later, he said it a second time. That’s an amazing two-fer. . . an embarrassing history and geography fail.

So why would anyone listen to him bloviate on what the market is going to do?!

Instead, MSNBC should’ve invited me and my crystal ball. Here’s what I woulda said.

The most credible analysts expect VERY modest annual returns over the next decade. Meaning low single digit. Even less than anticipated annual inflation, meaning negative nominal returns, especially after taxes.

So what’s a person who has gotten used to hardly any inflation combined with double digit market and housing price returns to do? To not lose ground. To continue building wealth.

There’s only one answer. Save more. How to save more? Earn more and/or spend less. Now, you probably know why MSNBC didn’t call me.

I’m a highly trained social scientist so the take-away from this graphic is obvious. To save 1.6% stop eating and don’t heat the crib this winter.

1. Dammit, this makes me sad. Forget the “sooner the better” sentiment. Extend the innocence as long as possible.

3. Okay Dan, Dan the Transportation Man. I concede, engineering can be cool.

4. What happens when primary health care is universal? The case of Costa Rica. What are we waiting for?