Seventeen year-old amateur swimming phenom Missy Franklin’s countercultural decision isn’t getting nearly as much ink as it deserves. I’ve lauded her parents’, coach, and her before. I’ll have to plead guilty if accused of putting a 17 year-old athlete on a pedestal.

If Franklin turned pro sports marketing experts agree she’d earn about $2m a year through product endorsements. Instead, she’s decided to swim at the University of California for a few years and then turn pro in 2015, one year before the Rio Summer Olympics.

Here’s the conventional wisdom on her decision:

While the opportunity to earn money from endorsement deals will not completely evaporate should Franklin delay becoming a pro-swimmer by competing at the NCAA-level, it will drastically impact the amount of money she will earn from endorsements. Not only will she miss out on a lot of money in some prime earning years for what are normally short Olympic careers, but she will likely also miss out on the chance to build her brand on a larger stage by way of the promotion and visibility that would come from advertisers using her in campaigns.

Another sports marketer adds, “I think it’s hard not to justify waving her amateurism. If I was an objective advisor to her and her family, I would advise this way: Her window to reap the rewards of her life’s work is relatively limited when you consider it over a traditional working career. As such, her potential earnings in the next four years will be five-times greater than what she’ll be able to make in the subsequent 30 years.”

My brother, who I may have been a tad too hard on the last several months, weighed in more creatively, “Missy-stake! Shoulda took the money.”

She’s rolling the dice on avoiding injury, finishing third in 2016 Olympic Trial races, and having Michael Phelps pressure her into a bong hit.

All you have to do for an alternative perspective, is turn to Franklin herself:

“Someday, I would love more than anything to be a professional swimmer, but right now I just want to do it because I love it. Being part of a college team is something that’s so special. I went on my recruiting trip, and the team was so amazing. Just being with those girls, I really felt like I belonged there. The campus itself is gorgeous. Everything about it was just perfect.”

Borrowing from the linked article above, Franklin said the opportunity to compete with close friends to earn points toward a team total, rather than simply attending school with them, was an allure stronger than the potential millions of dollars she could earn in endorsements. She actually wanted to commit to a full four seasons of swimming for Cal, but her parents told her “that would probably be the biggest financial mistake” she “could ever make.” Franklin acknowledged, “This can pay for your future family. This can pay for your kids’ school, things that I really have to think about. So that’s been the hard part.”

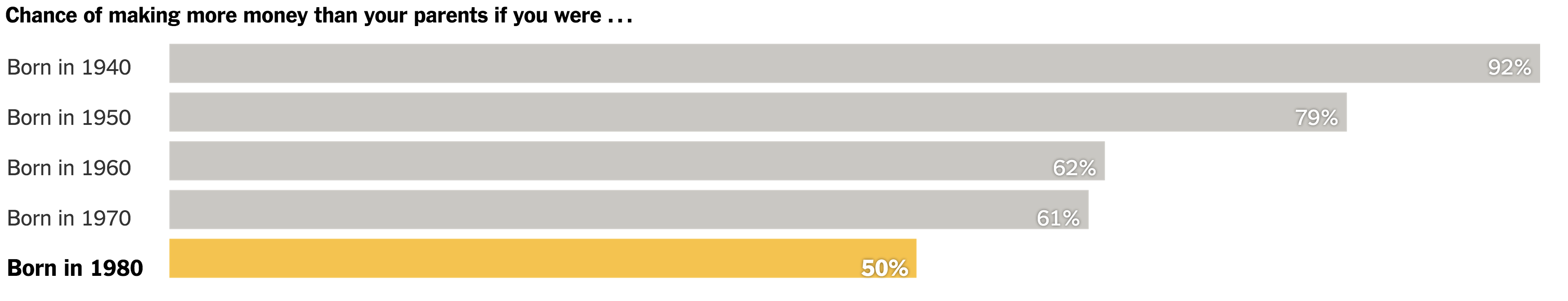

The materially minded majority will lament, “She’s paying about $6m for the opportunity to ride on busses and stand in security lines in airports with her college teammates in order to score points in college meets.” The assumption being she’d be two and half times happier with $10m in 2016 than $4m. What’s lost in that calculus is the fact that her parents are professionals and she’s grown up economically secure. She’s comfortable, she’s a good student, and with her family’s resources and a Cal degree, odds are she’ll continue to be comfortable.

And if comfort was her primary goal, she’d cash in now. She’s saying you can’t put a price tag on some things like memories of close friendships strengthened through athletic competition. She’s wise beyond her years. She probably knows that multimillionaires tend to get caught on an ever speedier treadmill, and as a result, never pause long enough to ask, how much is enough? Franklin, who I suspect is extremely confident she can swim as fast or faster in Rio, is saying $4m is enough.

And what if somewhere in the world right now there’s a 12 year old girl who out touches Franklin in Rio?

I have no doubt she’ll handle it with grace and dignity. “Honestly anything can happen,” she recently reflected. “You can’t predict the future, so whatever God has in store for me I’ll just go along with it.”